Learn

Topical news, tips, and guides from ITL Financial Planning.

- View all

- Blog

- Budget & EOFY Strategies

- Client story

- Learn

Client Portal Tutorials

ITL’s client portal is a third party platform powered by IRESS technology. It offers a secure way to share and sign documents. Here you will find a suite of “how to” videos designed to maximise your experience with the portal.

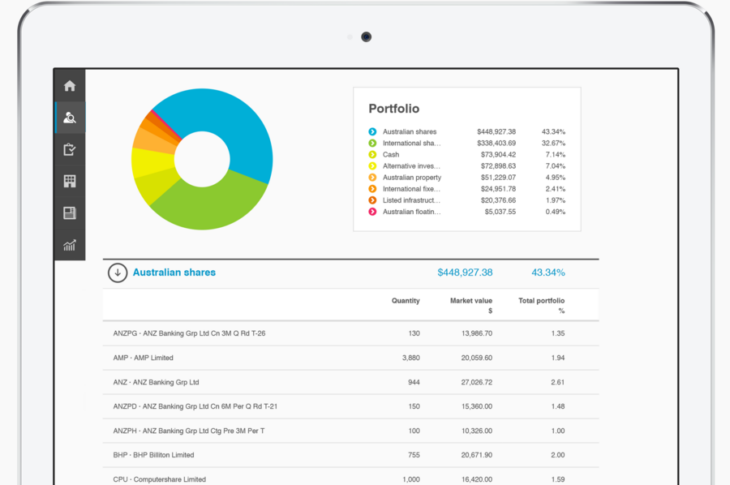

BT Panorama Tutorials

We’ve worked with BT Panorama to provide you with the following “how to” videos, which are designed to help you manage your accounts and billers, make payments and deposits as well as get the most out of the rich market and portfolio reporting it offers.

DocuSign Tutorials

DocuSign is a third party platform that ITL Financial Planning uses to streamline the implementation of our advice services. Here you will find some “how to” videos related to viewing and signing documents using DocuSign.

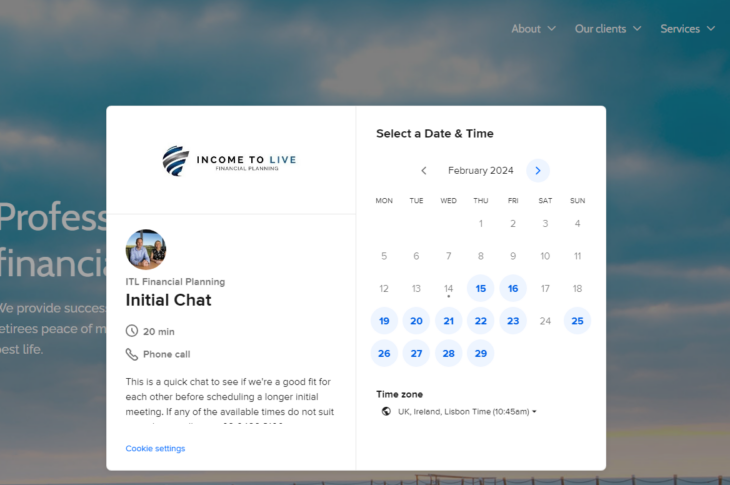

Calendly Tutorials

Calendly is our online booking interface. It allows you to schedule a time that works best for you to meet with one of our advisers. This tutorial provides a detailed and complete explanation of Calendly and how to use it.

ITL Financial Planning prescribes super medicine for two GPs

At ITL Financial Planning, we meet a lot of very successful business owners. People like Alan and Mary Brownell, who have a busy medical practice on Sydney’s north shore.

Planning your family’s financial future after a life-changing accident

Edward Morrison was engaged to be married and a competitive district footballer when he was paralysed in a car accident. At the age of 25 his life changed forever.

Is your SMSF working for you, or costing you?

Careful planning and attention to detail are things that civil engineer Colin Masterson has always prized in his work. But he suspected a poorly designed self-managed super fund was costing him dearly, and he needed to find a good financial planner to design and implement a SMSF investment strategy.

Our tried and tested approach to tailored portfolio construction

Learn how our experienced advisers construct your individually tailored investment portfolio based on our tried and tested approach.

Being super smart before the end of financial year FY23

The importance of making the most of the opportunities prior to 30th June this year is just as important as previous years. This is because legislation changes over recent years have seen the Government cracking down on how much you can get into super.

What the 2023-24 Federal Budget means for you

The 2023-24 Federal Budget has been delivered. The dominant theme was the cost of living.

MDA Portfolio Update May 2021

Watch our video to learn about the MDA portfolio update.

MDA Portfolio Update February 2021

Watch our video to learn about the MDA portfolio update.

ITL Financial Planning turns 10!

Today marks 10 years for ITL Financial Planning. To be honest, I wasn’t sure I’d get to this point when I started…

What the COVID-19 Stimulus Package means for you

We’re big advocates of the benefits of continually reviewing your situation to make sure you’re making the most of the available opportunities as and when they become available. The COVID-19 Stimulus Package signals the need for a review.

New Business Partner – Shereen Churchill

At ITL Financial Planning, our vision is to be best practice in everything that we do for our clients, giving them peace of mind and financial freedom.

Finalist in FPA Financial Planner AFP® of the Year Award

We are proud to announce that Nick Lloyd, Financial Adviser and ITL Financial Planning Owner, has been nominated as 1 of only 3 finalists for the FPA Financial Planner AFP® of the Year Award.

How well do you know your SMSF?

As experienced financial planners, ITL Financial Planning’s Nick Lloyd and Shereen Churchill meet a lot of self-funded retirees. Many of them choose to set up a self-managed super fund (SMSF).

How to achieve financial fitness

Anyone who wants to improve their physical health benefits, works with a personal trainer. Financial fitness is no different.

Transition to retirement planning at a financial crossroads

Talking to a financial planner helped Elizabeth and David reconsider their focus on real estate for building wealth for retirement when they faced a financial crossroads.

Thinking of leaving your financial planner? Breaking up is not hard to do.

If you’re thinking of changing financial planners, you’re not alone.

Self-Funded Retirees: Are You Prepared For Massive Changes To Super on 1 July?

Are you a self-funded retiree with more than $1.6 million in superannuation?

Big changes to super are coming soon – Are you prepared?

The most significant changes to super in 10 years are about to impact unsuspecting self-funded retirees, SMSF trustees and high income earners because of the haphazard way the changes have been introduced.

Transition to retirement

Are you ready to retire but wondering if you can afford to live without your regular paycheck? Or are you already retired, but finding your investments aren’t generating enough income to live? Or maybe managing your own SMSF is too much work?

Planning to start a family?

Congratulations! Whether you’re expecting your first child or adding to your existing brood, the arrival of every new baby brings anticipation, hope and so much love.

Investing an inheritance

If you’ve received a large sum of money, either as an inheritance or if you’ve been the lucky recipient of a windfall, smart strategies and investment decisions made now can enable you to maximise the return on your good fortune for years to come.

Coping alone

Dealing with loss of a life partner after death or divorce can be totally overwhelming.

Buying your first home

Buying your first home is an incredibly exciting event…but it can also be a very scary decision.

Downsizing

Are you still living in the family home? Have your children flown the nest or are you now on your own and finding your home too big or too much to maintain? Have you built up a lot of wealth in your property, but don’t have other assets to generate income for you in retirement?

Impact of 1 January 2017 Assets Test changes

In recent years there have been a number of changes to the social security pension rules. The latest change to soon take affect is the increasing of the Centrelink/DVA Assets Test thresholds and taper rate from 1 January 2017.

5 simple steps to move a parent into a nursing home

You are not alone. Moving a parent into an aged care home can be a painful and traumatic process.

How much is enough?

One of the most common questions we get asked is how much is enough to retire?

How am I tracking?

The second most common question we get asked is how am I tracking?

How do I compare?

By far the most common question we receive from clients is “How do I compare to others like me?”

4 ways to become financially fit

Whether you are managing family life or planning towards a self-funded retirement, there is a myriad of financial decisions to make.

The Great Home Loan Debate – to fix or not to fix?

The Reserve Bank of Australia’s latest rate cut has fired up the debate of fixed versus variable again.

Tips and Traps for SMSF’s

Having your own SMSF means being the trustee and this role comes with a long list of responsibilities and harsh penalties for getting it wrong.

Reduce the home loan or invest?

A common question asked by clients is whether they are better off using surplus funds to pay off their home mortgage or to make an investment.

Claiming on insurance

No-one wants to be good at claiming on insurance. That means something bad has happened.

Did you know you are worth over $2,000,000?

By far the most common question we receive from clients is “How do I compare to others like me?”

The Importance of an Investment Philosophy

A clearly prepared, well supported investment philosophy is your financial compass or rudder, a road map that guides you to your destination and plots your course.