How do I compare?

By far the most common question we receive from clients is “How do I compare to others like me?”

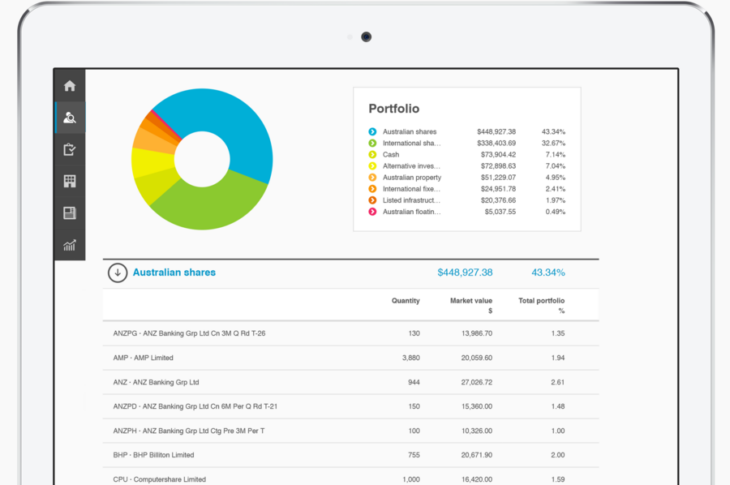

How does my savings compare? According to the SMH, the richest 20% of households in Australia save nearly 15% of their disposable income, double the median. So if you are saving at least 7.5%, you are saving a similar amount to households around you. If you are saving nearly 15%, you saving a similar amount to the top 20% of households in Australia.

We help our clients maximise their savings whilst still maintaining their best lifestyle. They generally save around 15-20% of their disposable income through smart and tax-effective strategies.

How does my super compare? According to Adelaide Now, households have an average $177,000 in superannuation savings, but for people aged 55-64 it’s almost $500,000.

We help our clients maximise their super whilst still maintaining a comfortable lifestyle. Our successful business owners and professional families (40+) have on average $500,000 in super and our self-funded retirees (60+) have on average $1,500,000 in super. We put this down to putting in place a well-structured and fluid financial and investment plan which is reviewed regularly. If these numbers look a little scary to you, rest assured there may be ways to catch up your superannuation (for example; your retirement savings may currently be tied up in your business).

Need help to put in place a well-structured and fluid plan to maximise your savings and super? Through proactive and professional advice, we give you peace of mind and freedom to make choices to live your best life. Contact us now.

ITL Financial Planning and its advisers are Authorised Representatives of Fortnum Private Wealth Ltd ABN 54 139 889 535 AFSL 357306. www.fortnum.com.au. Any information on this website is general advice only and does not take into account any person's objectives, financial situation or needs. Please consider your own circumstances and consider whether the advice is right for you before making a decision. Always obtain a Product Disclosure Statement (if applicable) to understand the full implications and risks relating to the product and consider the Statement before making any decision about whether to acquire the financial product.