The Importance of an Investment Philosophy

A clearly prepared, well supported investment philosophy is your financial compass or rudder, a road map that guides you to your destination and plots your course.

Imagine this.

You set sail alone to a distant destination in an empty boat without sails, a motor, a compass or a rudder.

You drift over the ocean, at the mercy of the prevailing winds, buffeted by huge swells, with no control over where you are going and no idea of when you will sight land again, let alone reach your destination.

Sounds scary, doesn’t it?

Now picture this.

You set sail in the same boat, but this time with an experienced skipper, GPS navigational equipment, a compass, sails, a fully serviced motor and a rudder.

You’re sailing on the same ocean, encountering the same prevailing winds and huge swells, but your boat is correctly equipped, you have confidence in the boat and your skipper has the experience to keep you on course… ensuring you reach your destination, on time and in one piece.

Your best chance of financial success

A clearly prepared, well supported investment philosophy is your financial compass or rudder, a road map that guides you to your destination and plots your course.

And an experienced financial adviser will work as your skipper, ensuring your finances stay on track regardless of the challenges life or the financial markets throw at you.

Together, they’re a winning combination…and your best chance of financial success.

Our Investment Philosophy

At ITL Financial Planning we tailor an investment strategy for your individual needs, based on our experience and consider all the following investment philosophies:

- Preserving capital is our top priority to prevent loss and ensure your income objectives can always be met.

- Diversification reduces your risk.

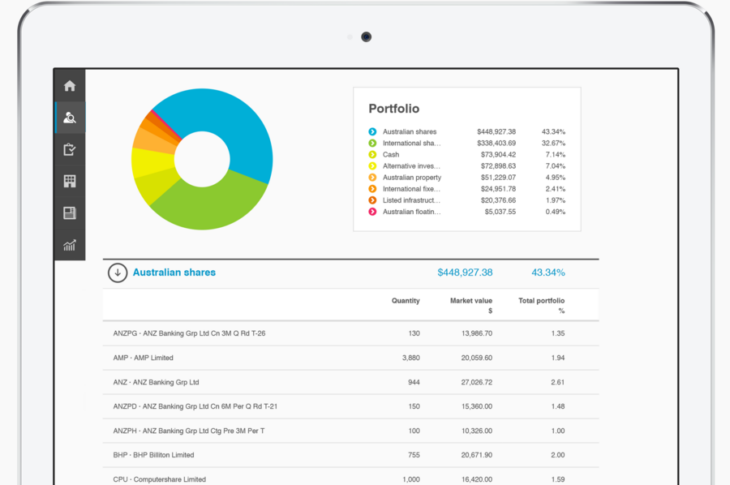

- Strategic asset allocation is the main driver of our investment returns – we are constantly reassessing and rebalancing your portfolio to maintain the appropriate level of risk you feel comfortable taking.

- Franked dividends are highly valuable for lower taxed entities – if you’re retired, tax effective investment income can provide the majority of your cashflow for retirement.

- Investment markets are inefficient over the short to medium term.

- Index share market returns are not necessarily aligned to your objectives because due to the concentration of banks, miners, grocers and a telco, the makeup of the ASX200 is not a diversified portfolio.

- Less volatile companies are positive for portfolios.

- Time in the market is more important than timing the market—it’s vital to remain patient and rational in decision making.

- The larger the market, the less scope to achieve alpha (ie. beat the index) and therefore index returns via low cost Exchange Traded Funds (ETF’s) can be preferable in well-developed international markets like the S&P500 index in the US.

A clear vision of where you’re going and how you plan to get there

At ITL Financial Planning we proactively manage your finances with as much commitment and interest as we do our own, constantly seeking to maximise your wealth.

And our investment philosophy can help you stay on track with your long-term goals, regardless of any short-term distractions.

Looking for a bespoke investment strategy based on experience and a proven investment philosophy?

Talk to us now.

Written by Nick Lloyd (Financial Adviser)

ITL Financial Planning and its advisers are Authorised Representatives of Fortnum Private Wealth Ltd ABN 54 139 889 535 AFSL 357306. www.fortnum.com.au. Any information on this website is general advice only and does not take into account any person's objectives, financial situation or needs. Please consider your own circumstances and consider whether the advice is right for you before making a decision. Always obtain a Product Disclosure Statement (if applicable) to understand the full implications and risks relating to the product and consider the Statement before making any decision about whether to acquire the financial product.