Investing an inheritance

If you’ve received a large sum of money, either as an inheritance or if you’ve been the lucky recipient of a windfall, smart strategies and investment decisions made now can enable you to maximise the return on your good fortune for years to come.

We can work with you to ensure it makes a lasting difference, rather than just being provided with a short-term bonus.

Congratulations!

Whether you’re expecting your first child or adding to your existing brood, the arrival of every new baby brings anticipation, hope and so much love.

Put your money in safe hands

When you’re not experienced in handling large sums of money, it can be very tempting to overspend or make ill-advised investment decisions you may come to regret later.

Having a plan in place ensures make it all count.

But if you want your money to last, it really makes financial sense to talk to a trusted financial adviser who:

- has an outstanding track record of investing wisely

- takes the time to understand your short-term and long-term goals

- specialises in estate planning, so you can provide for your loved ones and ensure your money remains within your bloodline

- can help you minimise your tax burden

- can advise you on different investment options, according to the level of risk you feel comfortable with

- is always available to answer any questions you may have

Grow and secure your financial future

Did you know that investing in the right financial advice actually saves you money, both in the short and the long term?

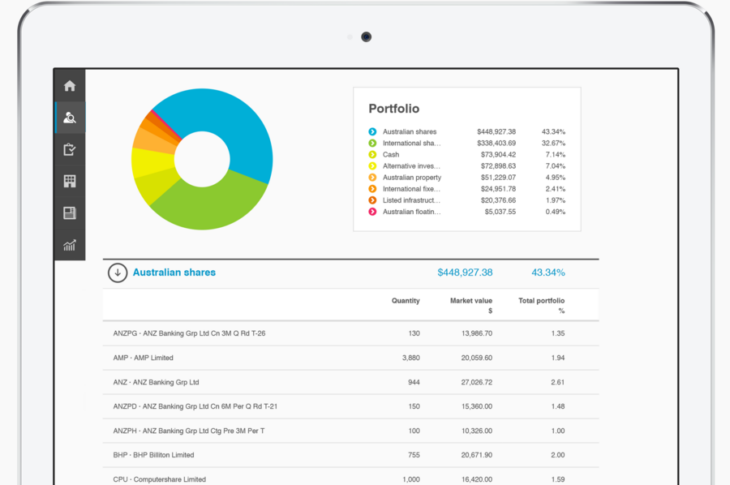

At ITL Financial Planning we work with many clients, just like you, to secure their financial future through effective wealth management.

We have a track record of being transparent, reliable and trustworthy and we will securely manage your finances just like we would manage our own.

We will help you protect, invest and grow your newfound wealth, ensuring you can enjoy your money today, but also ensure your future tomorrow.

If you want to enjoy your inheritance or windfall, without it becoming a burden, talk to us today about how we can ensure your good fortune continues to deliver to you and your family for many years to come.

ITL Financial Planning and its advisers are Authorised Representatives of Fortnum Private Wealth Ltd ABN 54 139 889 535 AFSL 357306. www.fortnum.com.au. Any information on this website is general advice only and does not take into account any person's objectives, financial situation or needs. Please consider your own circumstances and consider whether the advice is right for you before making a decision. Always obtain a Product Disclosure Statement (if applicable) to understand the full implications and risks relating to the product and consider the Statement before making any decision about whether to acquire the financial product.