5 simple steps to move a parent into a nursing home

You are not alone. Moving a parent into an aged care home can be a painful and traumatic process.

Often this can be exasperated by two big factors;

- Your parent(s), having lived independently for decades, are struggling with the idea of moving out of their family home.

- You’re struggling to find time in the chaos of juggling your own young family and demanding career to research and understand the complexity of the aged care system.

Here we outline our simple 5 steps process and how ITL Financial Planning can help you.

- Obtain an assessment

If your parents need a bit more help with basic tasks at home or if they need more intensive aged care services, an assessment is required to work out how much help and what types of care and services they need and may be eligible for. This could range from getting support in your parent’s own home to more complex aged care needs or moving into an aged care home.

You can find out more about the assessment process or book the assessment via the Government’s myagedcare website. This is a fantastic website full of helpful information and resources. It might well be that your parents could continue living at home, but get additional support to keep them safe, healthy, in their own home and part of their local community.

- Speak to your parents and siblings about what’s important to them

Finding the right level of care, in the right location at the right time is important for everyone.

Sometimes your parent’s ideal option may not be practical or financially viable so discussing a few alternative options is important.

- Obtain a clear understanding of your parent’s assets, liabilities, income, current expenses and possible future expenses

Compile a list of:

- Assets such as; home and home contents, car, bank accounts, shares, pensions, loans to children

- Income such as; Age or DVA Pension, superannuation pensions, dividends, interest

- Expenses such as; living expenses that would continue even after moving into care, private health insurance, home maintenance costs, home repair costs to make it ready for sale, home rental costs

You may find our aged-care-fact-find tool useful in collating all the relevant information needed.

- Review home options

Again, the myagedcare website is a great resource showing what is available in your area and this can then be a guide as to which facilities or services you want to look at more closely.

- Not every home has all services. The costs can vary significantly – by law every home must advertise their costs and services online.

- Location can be a big factor – close to family or transport.

- You will need to narrow down the search by elimination taking into consideration your goals and objectives, affordability and/or availability.

- Seek Advice

We take the time to understand your parent’s financial situation and listen to their aged care objectives to:

- We help by explaining, in plain English, how each of the aged care fee types are calculated, reduced where possible and most efficiently paid for.

- Determine the impact of each aged care option on their short and long term financial situation; including age pension, aged care fees, taxation and estate assets.

- Identify any opportunities to reduce their ongoing cost of care and maximise their Centrelink benefits.

- Determine whether they have sufficient cashflow to meet their ongoing cost of care and their combined living expenses.

- Determine the most appropriate way to fund upfront and ongoing cashflow and capital needs.

- Help you make an informed decision about the chosen aged care option.

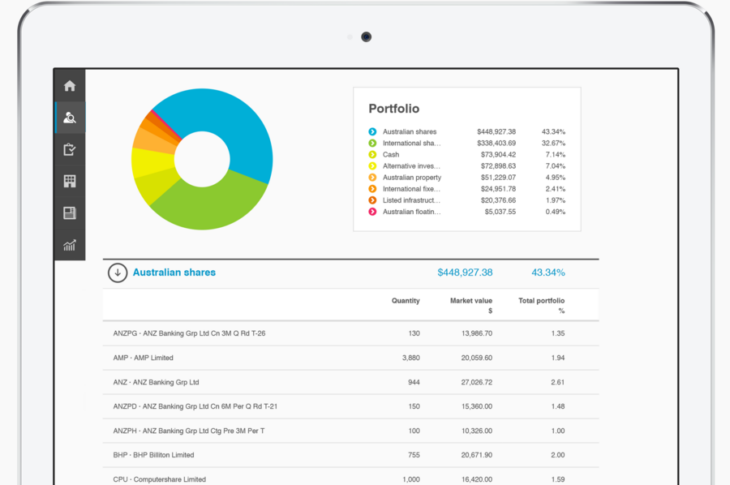

- Build and manage a tailored investment portfolio to fund any cashflow and capital needs.

- Help you get your parents estate planning in order, including obtaining an Enduring Power of Attorney & Guardianship (legal powers to make financial and lifestyle decisions on behalf of your parents). It’s important to work with solicitors who specialise in Estate Planning and get these documents in place before your parents lack the mental capacity to make their own decisions.

If you are considering moving a loved one into care, don’t feel alone, contact us now. You can also find out more about our aged care advice service here.

ITL Financial Planning and its advisers are Authorised Representatives of Fortnum Private Wealth Ltd ABN 54 139 889 535 AFSL 357306. www.fortnum.com.au. Any information on this website is general advice only and does not take into account any person's objectives, financial situation or needs. Please consider your own circumstances and consider whether the advice is right for you before making a decision. Always obtain a Product Disclosure Statement (if applicable) to understand the full implications and risks relating to the product and consider the Statement before making any decision about whether to acquire the financial product.